Texas title loans without proof of income offer quick cash to individuals with irregular employment, using their vehicle's registration and title as collateral. These loans bypass traditional credit checks and appeal to San Antonio residents facing emergencies or unexpected obligations. While a game-changer for some, understanding strict eligibility criteria and repaying capabilities is crucial to avoid predatory lending practices.

In the competitive financial landscape of Texas, understanding unique loan options is crucial, especially for those seeking solutions outside traditional banking. This article delves into the realm of Texas title loans without proof of income, a non-conventional approach to short-term funding. We explore how borrowers navigate approval processes and present alternative options for diverse financial needs, offering insights for folks seeking immediate relief without conventional documentation.

- Understanding Texas Title Loans Without Income Verification

- Customer Stories: Navigating Loan Approval Challenges

- Exploring Alternative Solutions for Financial Needs

Understanding Texas Title Loans Without Income Verification

When it comes to understanding Texas title loans without income verification, it’s essential to grasp that this type of lending is designed for individuals who may not have traditional employment or consistent income streams. In many cases, these loans are sought by those in need of quick cash for emergency expenses or unexpected financial obligations. The beauty of Texas title loans lies in their flexibility and accessibility; they offer a solution for folks looking to borrow funds without the stringent requirements typically associated with bank loans.

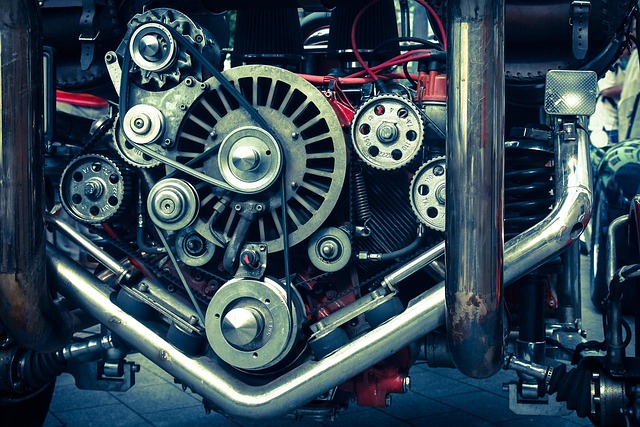

Without the need for proof of income, borrowers can secure a loan based on the value of their vehicle, specifically its registration and title. This alternative lending option is particularly appealing to residents of San Antonio seeking fast funding, as it provides a straightforward process that bypasses traditional credit checks. Whether it’s for paying off debts, covering medical bills, or even funding a semi-truck purchase, Texas title loans without income verification offer a path to financial relief for those in need.

Customer Stories: Navigating Loan Approval Challenges

Many customers who have sought financial assistance through Texas title loans without proof of income share similar stories of navigating challenging approval processes. These individuals often find themselves in situations where traditional loan options are unavailable or too restrictive, prompting them to explore alternative financing methods. Without conventional income verification, securing a loan can be an arduous task, leaving some borrowers feeling discouraged and frustrated.

However, some have successfully navigated these challenges by sharing their experiences with boat title loans as a viable option. These loans, which use the value of one’s vessel as collateral, offer repayment options tailored to fit diverse financial needs. The process involves a straightforward title transfer, making it accessible for those without traditional income documentation. This alternative approach has proven to be a game-changer for many, providing much-needed relief during times of financial strain.

Exploring Alternative Solutions for Financial Needs

When individuals face financial challenges and are unable to provide traditional proof of income, it doesn’t mean their options are limited. Exploring alternative solutions is a prudent step towards meeting immediate financial needs. Texas title loan without proof of income can be an option for those who own a vehicle and have a clear title. This type of secured loan allows individuals to leverage their asset as collateral, potentially offering more favorable loan terms compared to traditional unsecured loans.

Instead of focusing solely on high-interest rates and quick cash, it’s crucial to consider the overall loan eligibility criteria and long-term financial implications. Secured loans like these can provide a safety net during emergencies, but understanding the loan terms and ensuring one’s ability to repay is paramount. By doing so, individuals can avoid the pitfalls of predatory lending practices and find sustainable solutions for their financial needs.

Many Texans have found themselves in dire financial straits, prompting them to explore non-traditional loan options like Texas title loans without proof of income. While these loans offer a sense of relief for immediate cash needs, the lack of income verification can lead to challenging approval processes and potentially harmful debt cycles. However, understanding these loans’ intricacies and considering alternative solutions like budget planning or seeking assistance from community resources can empower individuals to make more informed decisions regarding their financial well-being.